Microchip: ‘Shared Pains’ in the Wake of a Supercycle

By Bolaji Ojo

What’s at stake?

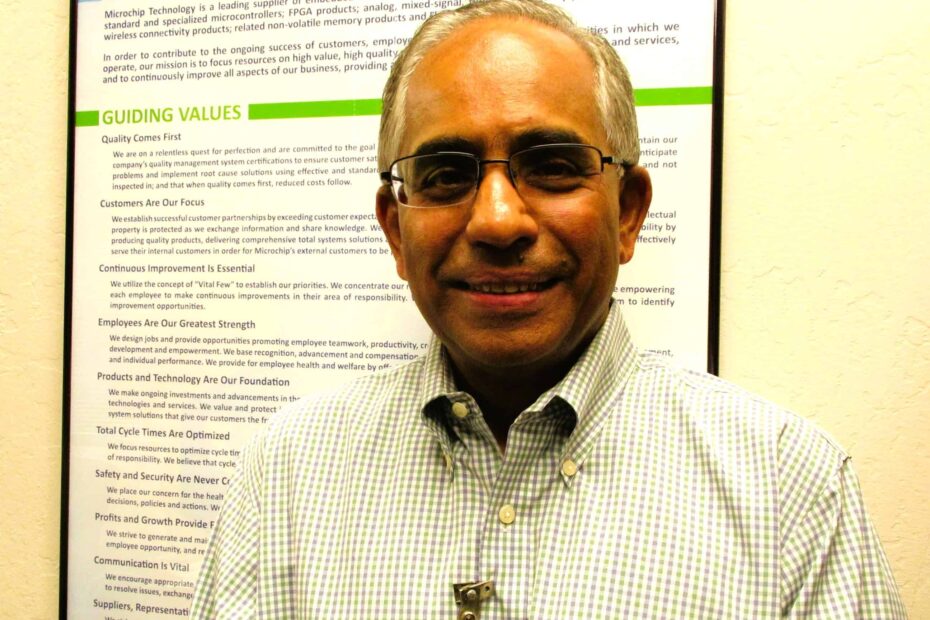

Microchip prides itself on being able to deftly wend its way through the semiconductor industry’s cycles by spreading the gains and the pains of each experience throughout the enterprise. The process is well tested and the long-term benefits to Microchip and its employees are numerous, company executives say. The current downcycle cuts deep, says CEO Ganesh Moorthy but the company is sticking with salary cuts and avoiding layoffs. Is the practice worth adopting? Moorthy takes our questions on Microchip’s distinct cycle management strategy and the turbulence of the electronics supply chain.

Microchip Inc. has been on a rollercoaster ride these last several years.

Between fiscal 2021 and 2023, the MCU chipmaker’s revenue soared more than 55 percent, fueled by torrid demand and supply shortages.

Now, in 2024, Microchip is on the downward slope. In the March quarter, revenues are forecast to slide 40 percent, year-over-year, and decline another 40 percent or more in June from the comparable 2023 quarter, eroding most of the gains the company has garnered over the previous years.

That should prompt drastic actions such as severe job cuts. This is how the industry typically responds to each of its sales crisis.

At Microchip, though, it’s the perfect time to trot out an old remedy, one the entire industry should watch closely, if not emulate.

Read More »Microchip: ‘Shared Pains’ in the Wake of a Supercycle