Is TSMC Price Hike Threat Even Enforceable?

By Bolaji Ojo

What’s at stake:

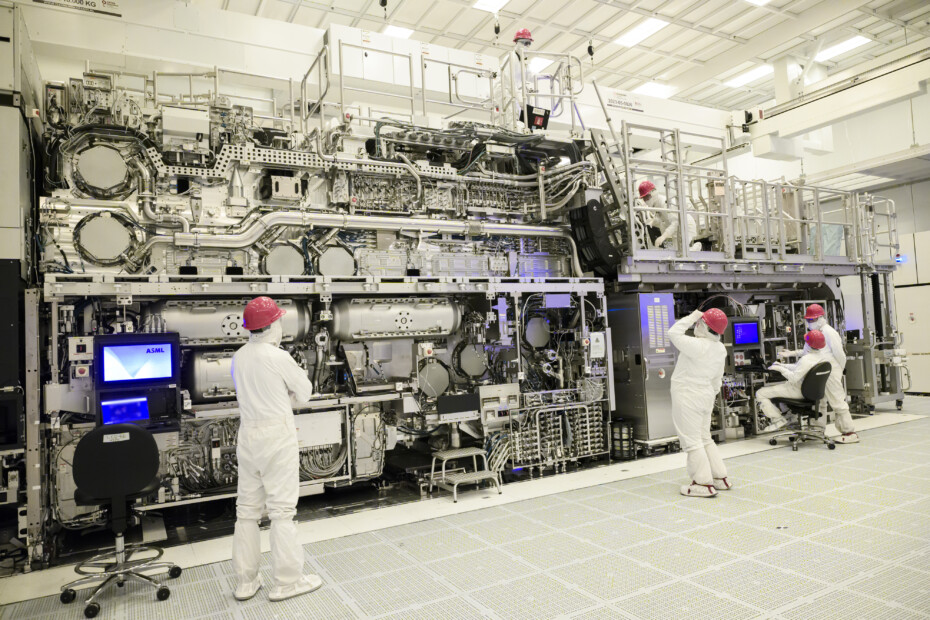

TSMC may be the world’s biggest chip foundry but, it is in the end, a contractor to even more powerful companies. The likes of Apple will not yield easily to pressures for wafer price increases just to help the foundry offset higher fab costs in the West. With competition stiffening from emerging and established foundries like Intel and Samsung, TSMC looks set to combine tight cost management with renewed appeals to customers for assistance in offsetting higher fab prices on its operations.

The chicken has come home to roost at Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC).

At a huge cost, the world’s No. 1 contract chipmaker is finally becoming a truly global enterprise – with as many as six new fabs planned for sites outside Taiwan – and it hurts. So, TSMC wants customers to soothe its pains by consenting to an unpalatable pricing hike.

“If my customer requests to be in certain areas, then definitely, TSMC and the customer have to share the incremental cost,” said C.C. Wei, CEO at TSMC, while presenting the company’s first quarter earnings results last week.

How exactly will this work?

Read More »Is TSMC Price Hike Threat Even Enforceable?