Are Tsetlin Machines About to Reframe AI?

By Peter Clarke

What’s at stake:

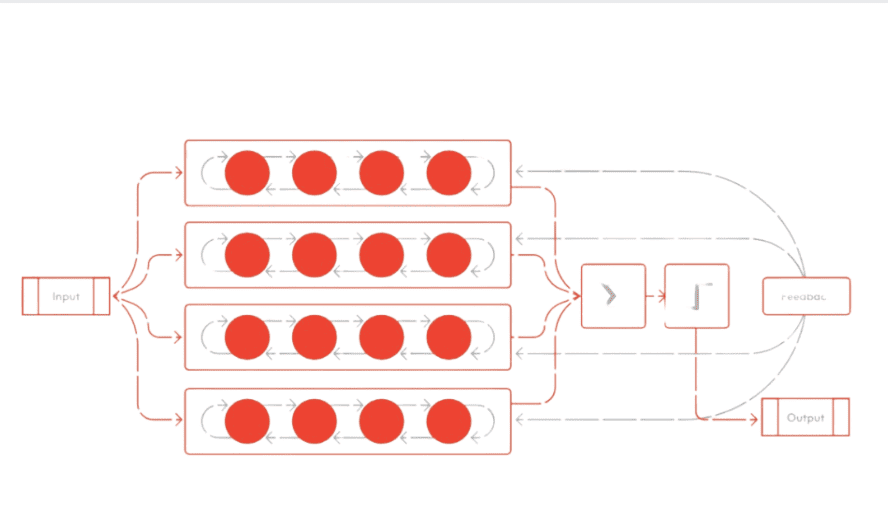

Right now, AI/ML is most powerful driver of technology but there are already signs that its runaway success is unsustainable on energy consumption grounds. Can a novel technology from a startup open up new frontiers in the artificial intelligence and machine learning (AI/ML) sector and ultimately impact the leaders of the semiconductor industry?

AI has a problem: the energy it consumes. A UK startup called Literal Labs may have a radical solution.

The company reckons a mathematical curiosity called the Tsetlin machine could provide an approach to many AI applications that is up to 1,000-times faster than GPU-based training and up to 10,000-times more energy efficient than today’s neural networks. If such efficiencies can be deployed while fitting into the established technology ecosystem, it could disrupt market leaders and enable AI at the edge, which has largely been stalled up until this point.

Read More »Are Tsetlin Machines About to Reframe AI?