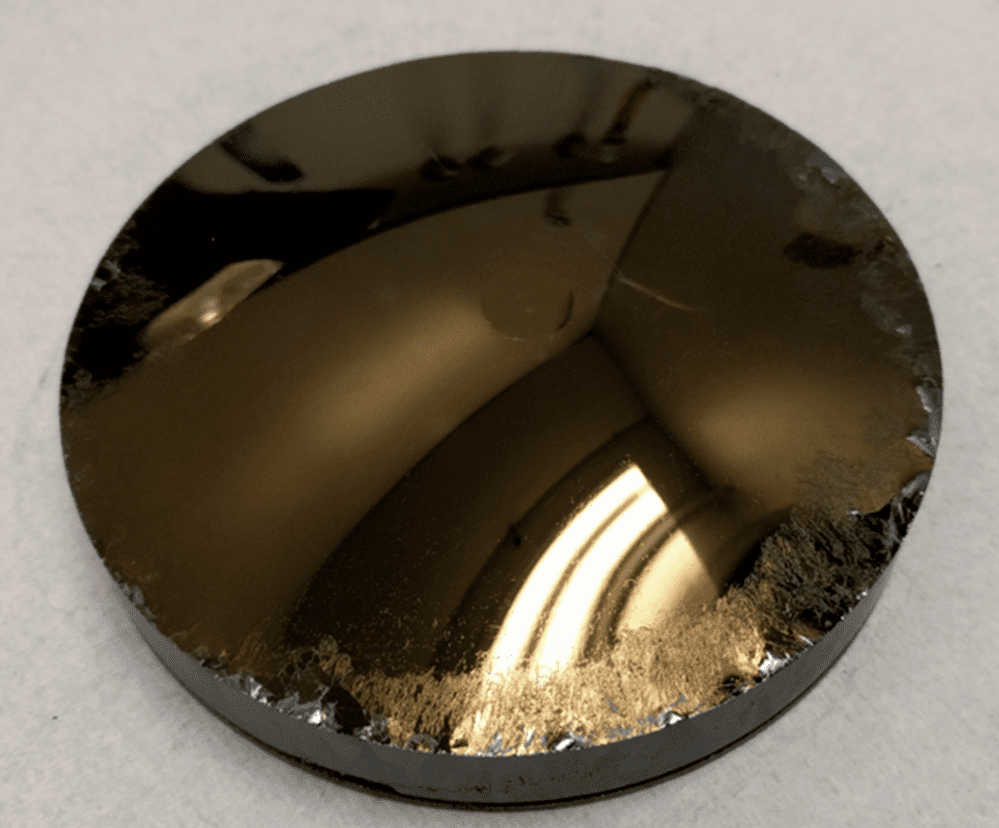

Is Consolidation Coming to SiC Production?

Infineon Ramps For the Transition to Silicon Carbide

A Certain Semiconductor in Uncertain Times

Onsemi Triangulates Its Silicon Carbide Strategy

SiC Manufacturers Walk a Tightrope

SiC in China: ‘Poster Child of the Decoupling Era’

Infineon Ramps For the Transition to Silicon Carbide

What’s at stake:

The race is on to leverage the performance gains of silicon carbide for automotive and industrial applications. Infineon and others seek to ease the transition from silicon via modular approaches. The harder part will be scaling SiC production to reduce cost.

With the steady electrification of cars, the suppliers of key EV power electronics components are expecting higher-performance silicon carbide (SiC) to overtake traditional silicon devices by the end of the decade.

A Certain Semiconductor in Uncertain Times

By Jean-Christophe Eloy, Yole Group (in collaboration with Poshun Chiu and Ezgi Dogmus, analysts at Yole Intelligence, part of Yole Group)

What’s at stake?

Thanks to automotive electrification, the silicon carbide semiconductor market is witnessing unprecedented growth, with industry players jostling for position. Big questions we ponder are who are best positioned to lead the SiC device market and who will eventually acquire whom.

Onsemi Triangulates Its Silicon Carbide Strategy

What’s at stake:

Silicon carbide remains a luxury technology: Nice to have but still pricey. New all-inclusive business models that allow chipmakers to produce SiC materials, devices and packages are seen as one way to scale the technology to reduce cost. Onsemi is among those with an early-mover advantage.

Early investors in the nascent market for silicon carbide (SiC) technology have a leg up on relative late-comers jumping on the power-electronics bandwagon being driven by electric vehicle and industrial applications. Among those advantages are the ability to address the emerging SiC market through a vertically integrated business model that enables across-the-board production of material substrates, or boules, wafers, devices and SiC packages.

SiC Manufacturers Walk a Tightrope

By Bolaji Ojo

What’s at stake?

Silicon carbide device designers and wafer suppliers are shifting to a vertically integrated business model — and spending lavishly on capex — betting that demand will remain strong for power electronics in high-growth markets. If those sectors falter, SiC suppliers will be left holding billions of dollars in unused capacity and raw materials.

The silicon carbide supply chain is engaged in a delicate balancing act.

To continue satisfying demand — already strong and expected to skyrocket — SiC manufacturers are investing or promising to invest billions of dollars in new fabs and processes for a market still in its infancy. But it’s potentially problematic that the growth projections for SiC products are largely based on hope.

SiC in China: ‘Poster Child of the Decoupling Era’

By Junko Yoshida

What’s at stake?

Fueled by booming electric-vehicle demand and the long-term goal of semiconductor self-sufficiency, China is committed to developing power electronics based on silicon carbide (SiC). What is China’s plan for leapfrogging Western SiC suppliers?

Here are the questions: Who are China’s SiC players? How much money is China pouring into nascent technology and production facilities? Are Chinese vendors devising different business strategies to conquer the SiC market? Each of these riddles keep global power-electronics executives awake at night.