(Source: indie Semiconductor)

By Chet Babla, senior vice president, strategic marketing, indie Semiconductor

If you consult any economic or current affairs news source today, you would be forgiven for thinking the global automotive industry is headed for catastrophic demise (again). The big European automakers’ recent quarterly financial results were overwhelmingly disheartening in terms of reported steep declines in profits, while US, Japanese and Korean automakers are faring little better. Global vehicle sales have been impacted by persisting unfavorable macro-economic conditions, while vehicle production has been hit by post-pandemic high inventory levels and automaker restructuring and production line shutdowns.

The threat of tit-for-tat cross-border import tariffs looms large, and there is a collective industry concern that fast-moving (and in some cases, state-subsidized) Chinese automaker exports will take what little lunch is left off the table from the incumbents. And to compound all these woes, the electric vehicle (EV) renaissance is apparently languishing in the slow lane, with automakers reporting waning consumer appetite for EV’s. This industry malaise has also impacted the semiconductor industry, with most automotive chip suppliers recently reporting challenging financial results and cautious near-term outlooks.

In the face of this seeming despondent industry dynamic, why then does the author contend that the long-term outlook for the industry — and specifically automotive semiconductors — is actually very positive? First, set aside macroeconomics, which is, of course, a wildcard. But as the World Bank and IMF have recently observed, the global economy is recovering, albeit slowly and at different national paces, and will need on-going political stability and international trading resolve to avoid falling back into the doldrums. But assuming that the global economy will steer a path of stable recovery through 2025, global interest rates will continue their downward-inching trajectory, and consumer demand – including for new vehicles — will start to return over the coming year or two.

Embracing positive industry disruption

But will it only be the fast-growing Chinese automakers, especially the EV automakers with significant supply chain advantages (especially for batteries), that reap the benefits of a recovery? Suffice it to say that whenever the steady state is challenged by a capable new entrant in any industry, a massive spurt of innovation is unleashed, and incumbents are forced to raise their game to compete. The alternative is irrelevance and obsolescence — think of the well-known examples of Blockbuster, Kodak, Nokia and Palm. While incumbent European, US, Japanese and Korean automakers are not about to disappear overnight, fair and strong competition from new entrants will catalyze wider industry reinvention and innovation (and perhaps, unfortunately, some automaker casualties) — but ultimately, this disruption will benefit the global car-buying consumer.

Vehicle semiconductor content expansion is being driven by the automotive megatrend trinity of driver safety and automation, in-cabin user experience and electrification

So, what about automotive semiconductors? Why is the long-term outlook positive for this segment given market analysts such as S&P Global Mobility forecast vehicle production volume only growing from 90 million vehicles in 2023 to 98 million in 2030 (a lackluster compound annual growth rate (CAGR) of just over 1%)?

The answer lies in the fact that vehicle semiconductor content expansion is being driven not by vehicle volume growth, but by the automotive megatrend trinity of driver safety and automation, in-cabin user experience and electrification. In fact, S&P forecast that the total addressable automotive semiconductor market (TAM) will grow from almost $82 billion in 2024 to nearly $149 billion by 2030 – an impressive CAGR of 9% over this period, and a trajectory that outpaces the overall semiconductor industry growth according to McKinsey. This TAM equates to an average semiconductor content per vehicle of around $900 today, to over $1500 in 2030. And consider that this is the average content per vehicle — premium, luxury, and electric vehicles can easily feature two to three times the average semiconductor content due to the various additional electronic features and capabilities.

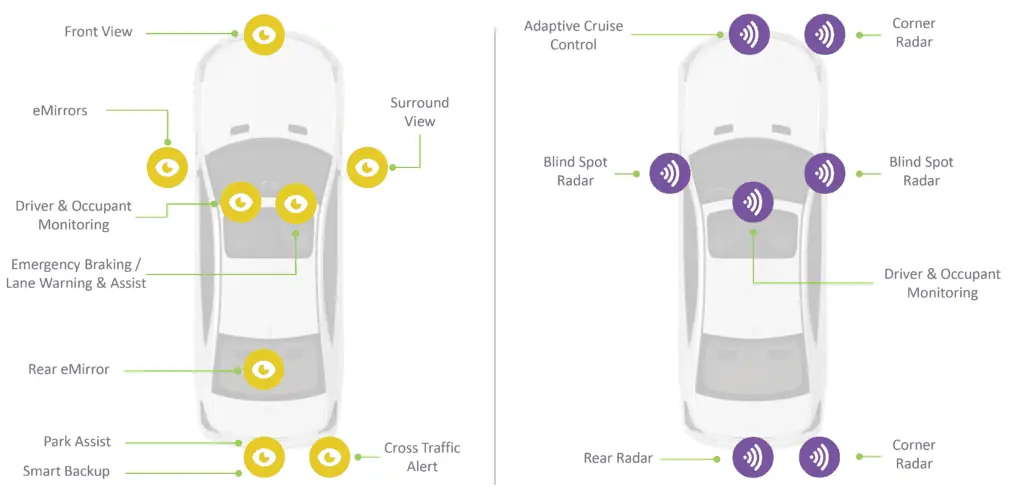

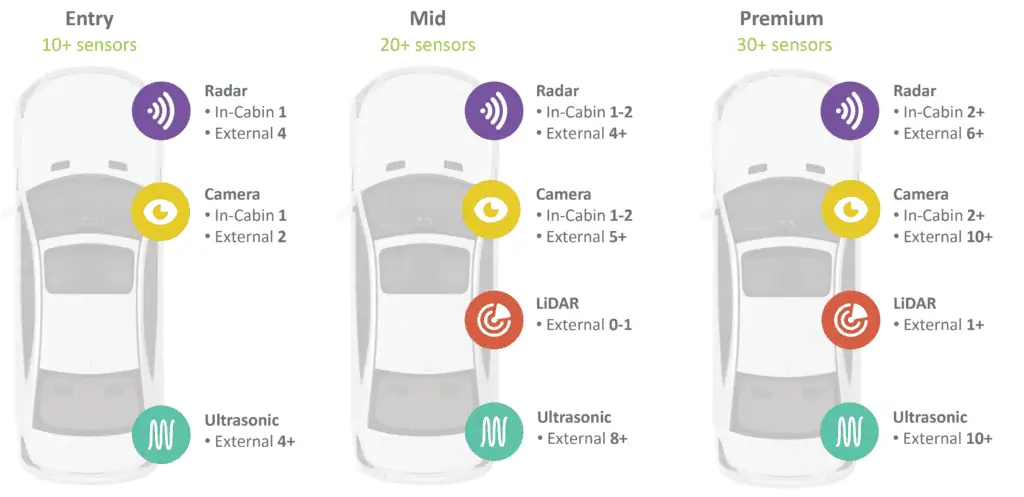

Let’s consider driver safety and automation. While the promise of self-driving vehicles has taken the lion’s share of media commentary in recent years, it is advanced driver assistance systems (ADAS) for road safety that are accelerating the need for more sensors and semiconductor-enabled processing content in today’s production vehicles. The goal of ADAS is to mitigate the tragic loss of over 1 million lives on our roads each year: over 20,000 deaths on European roads, more than 40,000 in the US, and, staggeringly, greater than 200,000 each annually in China and India. Cameras, radars, ultrasonic sensors and LiDARs are proliferating in vehicles of all classes to support functions such as automatic emergency braking (AEB), blind spot detection (BSD), detection of vulnerable road users (VRUs) such as cyclists and pedestrians, and in-cabin driver and occupant monitoring systems (DMS, OMS).

S&P forecasts that the semiconductor content enabling ADAS in an average vehicle will increase from $160 today, to over $260 in 2030.

What is critical to note is that these sensing use cases are increasingly being mandated in law by global regulations such as Europe’s General Safety Regulation or, in the US, the National Highway Traffic Safety Administration (NHTSA’s) Federal Motor Vehicle Safety Standard 127. Additionally, and orthogonal to these specific governmental regulations, consumer-facing new car acceptance programs (NCAPs) are incentivizing automakers to incorporate safety features by awarding new models with higher safety ‘star’ ratings.

As a result of these catalysts, S&P forecasts that the semiconductor content enabling ADAS in an average vehicle will increase from $160 today, to over $260 in 2030. And it should also be noted that additional sensor-enabled capabilities such as lane centering, adaptive cruise control (ACC), eMirrors and surround view, while not explicitly considered safety features but rather optional convenience features, are also incrementally contributing to growing vehicle semiconductor content. In fact, while an entry-class vehicle today may feature around 10 ADAS sensors, premium and luxury vehicles now integrate upwards of 30 sensors spanning multiple modalities, and all enabled by semiconductors. While future fully autonomous vehicles will integrate an even larger sensor set, it is ADAS that is actively contributing to semiconductor content growth in today’s production vehicles, and more importantly, improved road safety and helping to save lives.

Next, turning to the pursuit of more engaging and immersive in-cabin user experiences (UX). A little over a decade ago, UX in a car was essentially about how good the in-vehicle infotainment (IVI) system was — and primarily, this was related to the quality of the audio system. Fast-forward to today, carmakers have recognized that the smartphone and portable device revolution (accelerated by rich, app-enabled operating systems), combined with the ubiquity of affordable electronics, has reset consumer expectations of the experience they demand as drivers and passengers from their vehicle journeys.

Of course, drivers and occupants still need basic information about their vehicle and journey, but they also want to create more personalized environments. This personalization includes: seamlessly interfacing personal devices into the IVI system through Apple CarPlay, for example, while also enabling efficient wireless or USB-based charging for on-the-go power; enjoying high quality, low latency video content throughout the vehicle and across multiple displays; customizing the cabin lighting ambience to individual preference for brightness, hue and saturation; electrified utility functions such as motorized air vents and storage flaps, multiway seat adjustment and ventilation, and even haptic and smart interactive surfaces. This new wave of in-vehicle UX is driven by the latest mixed-signal semiconductors, designed to be hyper-conscious of power and thermal constraints (in the case of portable device charging, LED lighting and small motor control), and with the requisite performance to ensure high-speed, low latency data transport (in the case of USB connectivity and video display). S&P estimates that IVI and convenience features account for over $350 content per vehicle today, and will grow to nearly $550 by 2030, reiterating the criticality of this megatrend towards the growth of total automotive semiconductor content value.

Lastly, we turn to drivetrain electrification. Recent media and analyst sentiment on EV’s has been negative, highlighting a slowdown in global EV sales, a consumer re-embrace of hybrids, insufficient charging infrastructure roll-out, the higher prices of EVs relative to their carbon-burning counterparts, and the rapid growth of lower-priced Chinese EV imports.

While some governments have relaxed near-term emissions targets for automakers as a result of the global economic downturn, the progress toward new car fleet emissions targets, especially in Europe, is actually very encouraging.

But take a step back from the macroeconomic and geopolitical dynamics and consider the fact that global regulation and the climate change imperative are persistent long-term drivers for an electrified future. Many nations have enacted or proposed new regulations stipulating that the total tailpipe emissions from automaker vehicle fleets must follow a clear downward reduction, with a goal of totally phasing out sales of combustion engine vehicles in many countries over the next 10-20 years. As an added ‘incentive’, in Europe, for example, automakers are also faced with significant fines for missing emissions targets.

And while some governments have relaxed near-term emissions targets for automakers as a result of the global economic downturn, the progress toward new car fleet emissions targets, especially in Europe, is actually very encouraging and the majority of global automakers are committed to meeting the regulatory targets, albeit on a slightly longer timescale. Additionally, the much-reported slowdown in EV production and sales needs to be taken in context: while sales of EVs have inarguably slowed in 2024, especially in Europe and the US, global EV sales growth this year is still over 20%, with China at the vanguard of this growth. S&P forecasts EV production CAGR between 2023 and 2030 will increase by over 19%, while combustion engine vehicle CAGR will decline at nearly 12% over the same period, with EVs representing over 40% of total vehicle sales by 2030. The long-term direction of travel of the electrification of vehicles is therefore clear, and this is driving a corresponding increase in automotive semiconductor content.

While a large proportion of the incremental semiconductor content in EVs comprises discrete components (many based upon silicon carbide and gallium nitride) for high voltage invertors and DC-DC convertors, EVs still require sophisticated analog sensing and power control, and microcontroller-based battery monitoring and management. In the absence of legacy supply chain restrictions, EVs are also better suited to rapidly adopt the newest processing-enabled zonal and centralized compute electrical and electronic (E/E) architectures. As a result, S&P forecasts over $270 of electric powertrain-specific semiconductor content per EV by 2030, double the figure today, and this does not consider the incremental semiconductor content that EV E/E compute architectures will command.

An outlook of optimism

While the current turbulence in the automotive industry cannot be ignored or underplayed, as the macroeconomic environment continues to improve, consumer confidence will return, and automakers will once again see growing demand for new and innovative vehicles. For sure, there are many commercial and geopolitical challenges ahead for the automotive industry, but this will be the new norm in a globalized market operating with complex international supply chains and vested nation state interests. But in the context of this market dynamic, the automotive semiconductor industry has reason to be optimistic — the automotive megatrends and the availability of greater compute power to enable software-defined functionality are inexorably accelerating vehicle semiconductor content, supported by global road safety and emissions regulations, and insatiable consumer demand for ever improving in-cabin UX.

The author is Chet Babla, senior vice president, strategic marketing, indie Semiconductor.

Copyright permission/reprint service of a full TechSplicit story is available for promotional use on your website, marketing materials and social media promotions. Please send us an email at [email protected] for details.