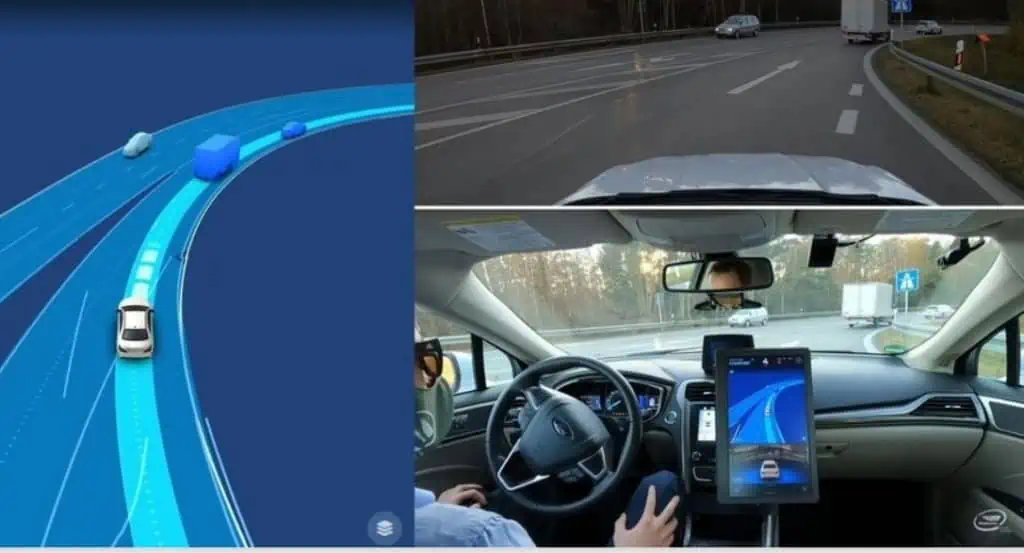

What an AV sees (Source: Mobileye)

By Colin Barnden

According to media reports, Mobileye’s IPO has been postponed. Even a cursory glance beneath the corporate spin reveals why.

In early December, Intel announced its intention to take Mobileye public in the U.S. in mid-2022 via an IPO of newly issued Mobileye stock. By mid-April, reports surfaced that Goldman Sachs and Morgan Stanley had been appointed to lead the IPO. But this week all those plans were tossed in the ditch.

What is going on?

Let’s set aside Mobileye CEO Amnon Shashua’s assertion that “our business is thriving, we are growing on all fronts, and the future was never brighter” and concentrate on three critical issues.

Death of the ‘self-driving’ dream

Upon Intel’s purchase of Mobileye in March 2017, Brian Krzanich, Intel’s CEO, triumphantly announced the deal as “the technology foundation on which the future of autonomous driving will be built.” Fast-forward to today, and we can see that autonomous driving in privately owned passenger vehicles is a technology with a promising future behind it.

The fundamental problem for machine driving is that roads are complex, not complicated. The majesty, beauty and unpredictability of the natural world cannot be reduced to a series of mathematical rules and assumptions expressed in lines of code that AI can follow to eliminate vehicular collisions. Neither can machine learning overcome complexity through brute-force training.

Mobileye and others will ultimately stall at the same roadblock: How to train a machine using probabilistic AI to demonstrate judgment under uncertainty in a complex system?

Complexity is the reason a Waymo robotaxi was bamboozled by a single stationary traffic cone, and why multiple Cruise robotaxis blocked a street in San Francisco until humans arrived to remedy the problem by manually driving the vehicles away.

Even using state-of-the-art sensors and incomprehensible quantities of processing, Argo AI, Aurora, Cruise, Motional and Waymo, along with

In a world of falling equity valuations and quantitative tightening, we can expect funding for this problem to run out long before anyone has the answers. Replacing human drivers with machine drivers in a complex environment is neither as quick nor as easy as many of these companies wanted to believe.

That dream of jumping into your own car, engaging “self-driving” and falling asleep while being safely chauffeured to your destination — that’s dead. What’s more, the automakers all know it.

Rise of supervised automation

Mobileye’s technology portfolio encompasses longitudinal and lateral driver assistance (such as automatic emergency braking and lane-keeping), with autonomous driving still in R&D. But in the race to secure the riches promised by self-driving, Mobileye overlooked the importance of a third category, now known as “supervised automation.”

Supervised automation includes systems such as GM Super Cruise, Ford BlueCruise and Jeep Active Driving Assist. These systems offer a hands-free highway driving function that operates in collaboration with the human driver, who undertakes the role of “automation supervisor.” The human is further backed up by a sophisticated and robust driver monitoring system (DMS) to monitor attention and engagement in the supervision task, thereby overcoming automation complacency.

Recommended: Delayed Mobileye IPO May Mean Delayed Intel IDM 2.0

However, it is Qualcomm, not Mobileye, that is dominating design wins for next-generation supervised automation systems.

GM was the first automaker to adopt Qualcomm’s Snapdragon Ride SoC, followed last November by BMW for its Neue Klasse platform. At the time of the announcement, I observed that if Qualcomm could take BMW from Mobileye, it could take Mobileye’s entire business.

So far in 2022, that is precisely what Qualcomm has been busy doing. It has already announced ADAS partnerships with Renault and Volkswagen, while Stellantis has committed to a technology collaboration with BMW to develop STLA AutoDrive using Qualcomm SoCs.

Underpinning Qualcomm’s recent ADAS success is its purchase of the Arriver computer vision, drive policy and driver assistance assets from Veoneer for $4.5 billion. That ranks as possibly the best value acquisition I have seen in my career.

At CES in January, Intel made very high-profile announcements of Mobileye’s wins with Volkswagen and Ford for premium driver assist.

But Qualcomm has since snared Volkswagen, which raises the question of whether Ford has already followed suit. Will the next generation of Ford’s BlueCruise use Qualcomm’s SoC with Arriver’s software, instead of Mobileye’s EyeQ SoC and software?

Obvious clues, if not the definitive answers, would have been included in the “Risk Factors” section of any Mobileye IPO prospectus. With the IPO postponed and Shashua’s assertion that “the future was never brighter,” I’m going for a Qualcomm win at Ford. We’ll know for certain soon enough.

Lack of a coherent DMS roadmap

With efforts stalled to replace humans as drivers in privately owned passenger vehicles, attention has turned instead to the use of technology to make human drivers into safer drivers. The critical technology necessary to achieve this is DMS. Driver monitoring is not “nanny tech” to spy on and nag drivers; rather, it is safety technology that sees and understands human behavior as it applies to accident risk.

As I’ve noted, however, neither Intel nor Mobileye appreciated the significant role that DMS would come to play in road safety. Qualcomm made no such error and today is partnered with Seeing Machines, the DMS technology leader. (The leading suppliers of DMS, and the key competency indicators leading to success in the DMS market, are discussed here.)

Mobilend?

History is littered with examples of suppliers that once dominated their respective industry but failed to react to key technology pivots and subsequently fell into obscurity or bankruptcy. Atari, Blockbuster, Commodore, Kodak, and Sega were all the future once.

But it is Nokia that is perhaps the best example of what may lie ahead for Mobileye. Nokia dominated mobile phones, even offered smartphones, and also had its own operating system. But Apple’s iPhone was simply a better product that was easier to use, and once it opened up the development platform with the introduction of the App Store, a tide of innovation and creativity was unleashed that neither Apple nor anyone else could possibly have foreseen.

Exactly what Intel or Mobileye planned to achieve by postponing Mobileye’s IPO isn’t clear. Tactically, all it does is buy time for Qualcomm to build more momentum and establish further ADAS and supervised automation partnerships with still more automakers. Winning Ford is a guess, but Qualcomm has already nabbed Volkswagen and might even have won Toyota too.

As the leadership at Nokia likely discovered, corporate endings typically follow the same script: gradually at first, then suddenly.

Colin Barnden is principal analyst at Semicast Research. He can reached at colin.barnden@semicast.net.

Copyright permission/reprint service of a full Ojo-Yoshida Report story is available for promotional use on your website, marketing materials and social media promotions. Please send us an email at talktous@ojoyoshidareport.com for details.