Intel may not Survive Another Bad CEO Verdict

By Bolaji Ojo

What’s at stake:

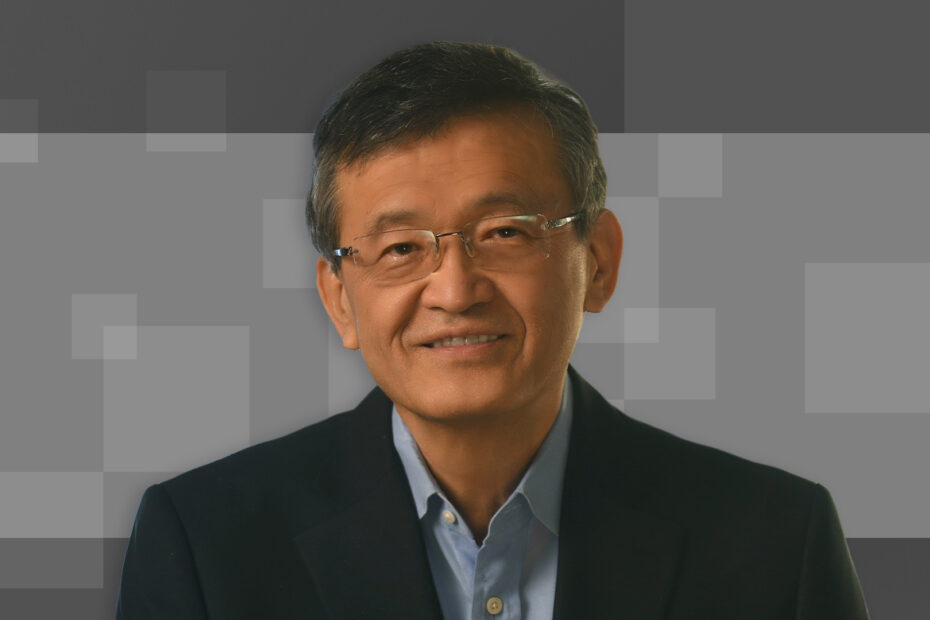

Patrick Gelsinger’s tenure as CEO is behind Intel Corp.. For his successor, Lip-Bu Tan, though, a review and study of his predecessor’s actions, successes and missteps could be instructive. Avoiding Gelsinger’s errors – in targets set for himself and employees as well as promises to investors and workers – can help Tan avoid Gelsinger’s fate, which would plunge Intel into a hole it cannot recover from.

Today is Lip-Bu Tan’s second day at Intel Corp. as CEO. He should be under no illusions about the task he has accepted and what the main charge from the board of directors would have been: to raise Intel’s market value.

If Intel didn’t state it so clearly while considering Tan for the job, the semiconductor industry veteran would surely have deduced this himself from his immediate predecessor’s fate.

Many analysts and observers, including the Ojo-Yoshida Report earlier this week, have raised the question of whether the new CEO should keep Intel intact or spin off the foundry operation. The subject is important, but it must represent only a minor factor, considered only as a first step towards the achievement of a grander and more relevant objective, which is that the market must like Tan’s actions enough to respond by elevating the company’s market capitalization.

Read More »Intel may not Survive Another Bad CEO Verdict