Can AI Pave the Way for Multi-die Systems?

By Ron Wilson

What’s at stake:

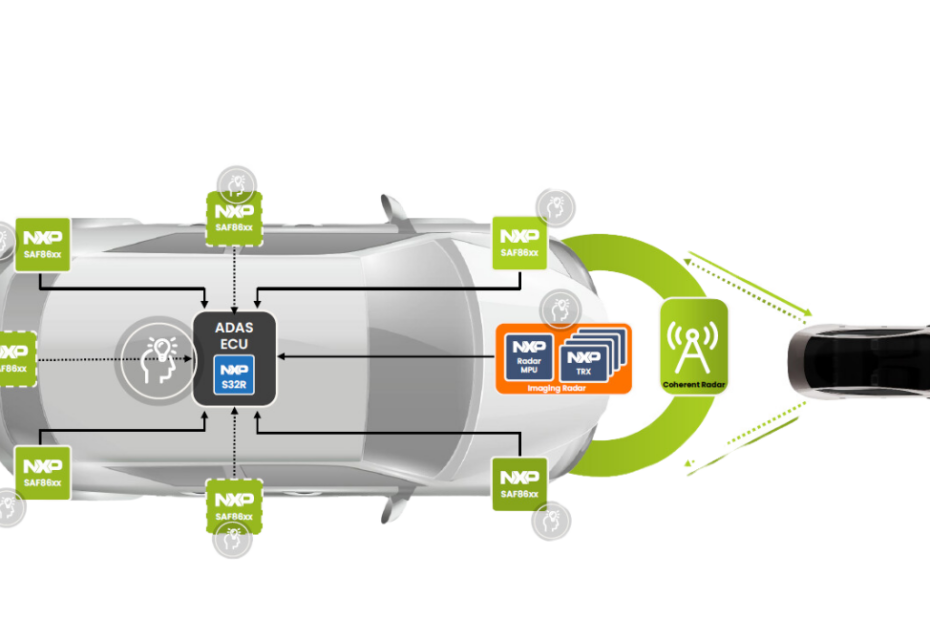

There is growing discussion of AI in chip design. Could this be mainly marketing, or could it reflect a new weapon in the EDA armory? If the latter, AI could take on some of the most intractable challenges of designing multi-die systems.

Global industry is placing huge bets that artificial intelligence will create a step-function increase in productivity. From customer service to materials handling, from bond trading to medical research, this faith thrives across a broad domain. But what exactly do these faithful mean when they say AI? There are many species in that phylum. And how exactly will AI — demonstrably excellent at pattern recognition and parlor games, but with fundamental limitations when it comes to accuracy and predictability — make knowledge workers more productive?

The EDA industry, with its witheringly complex tasks, massive data sets, vastly skilled practitioners, and utter intolerance of error, offers an excellent laboratory for exploring these questions. The emerging field of high-performance multi-die modules in particular includes some of the most formidable challenges. And among the tasks in this area, the challenge of multi-physics analysis of modules — analyzing the interacting electromagnetic, thermal, and mechanical properties of a module design — can be most daunting. This may be a great place to ask our questions.

Read More »Can AI Pave the Way for Multi-die Systems?