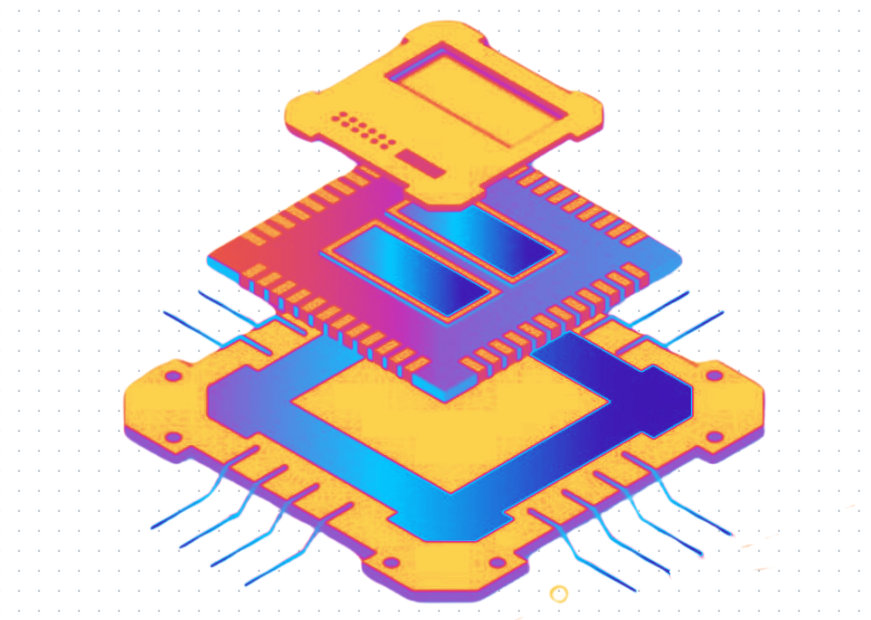

Chiplets: What Lies Below?

By Ron Wilson

What’s at stake:

One of the most important issues — and one of the least discussed — in creating multi-die systems is the substrate technology. There are several roads into the future, going in different directions. But one of them holds unique promise.

Much of the current excitement about chiplets tends to overlook an important point. Every multi-die system-in-package rests — quite literally — on a substrate. The characteristics of that substrate influence everything about the finished system, from the architecture to the cost to the likelihood of it ever reaching customers.

Read More »Chiplets: What Lies Below?