Acute Shiny Object Syndrome Can Ruin You

All that glitters is not gold. Companies must use caution in chasing targets they can’t capture or objects that are less valuable than imagined.

All that glitters is not gold. Companies must use caution in chasing targets they can’t capture or objects that are less valuable than imagined.

“AI is still new,” says Tenstorrent COO Keith Witek. The startup is plotting to find an opening by listening to customers, instead of following the playbook of successful AI incumbents like Nvidia.

TSMC’s disaster recovery plans helped with the quick restoration of production at its fabs after Taiwan was hit with a 7.2 magnitude earthquake.

By Bolaji Ojo

What’s at stake?

Microchip prides itself on being able to deftly wend its way through the semiconductor industry’s cycles by spreading the gains and the pains of each experience throughout the enterprise. The process is well tested and the long-term benefits to Microchip and its employees are numerous, company executives say. The current downcycle cuts deep, says CEO Ganesh Moorthy but the company is sticking with salary cuts and avoiding layoffs. Is the practice worth adopting? Moorthy takes our questions on Microchip’s distinct cycle management strategy and the turbulence of the electronics supply chain.

Microchip Inc. has been on a rollercoaster ride these last several years.

Between fiscal 2021 and 2023, the MCU chipmaker’s revenue soared more than 55 percent, fueled by torrid demand and supply shortages.

Now, in 2024, Microchip is on the downward slope. In the March quarter, revenues are forecast to slide 40 percent, year-over-year, and decline another 40 percent or more in June from the comparable 2023 quarter, eroding most of the gains the company has garnered over the previous years.

That should prompt drastic actions such as severe job cuts. This is how the industry typically responds to each of its sales crisis.

At Microchip, though, it’s the perfect time to trot out an old remedy, one the entire industry should watch closely, if not emulate.

Read More »Microchip: ‘Shared Pains’ in the Wake of a SupercycleWhat’s at stake:

Before the U.S. CHIPS Act changed the formula worldwide, “manufacturing” was a millstone around every semiconductor company’s neck. STMicroelectronics is turning this burden into a bonus, pitching its manufacturing ability to differentiate from competitors. But, will it work?

STMicroelectronics is a solid, non-nonsense semiconductor company proud of having built its business brick by brick. Its acclaimed MCU product lines are supported by an unparalleled developer community.

For decades, the Franco-Italian company stuck with its integrated device manufacturing (IDM) model, even when manufacturing lost its cachet in the industry. That trend prompted many chip companies to go fabless or “fab lite” in the early 2000’s.

As an IDM, ST today does everything from R&D, process technology development and product design to running several fabs, manufacturing, testing, and packaging.

Uninterested in the market trend du jour, rooted in a long market view with disciplined operations, ST is flourishing. It ships “4,000 to 5,000 MCUs every minute,” said Remi El-Ouazzane, ST’s President of Microcontrollers, Digital ICs and RF products Group, in a wide-ranging interview with The Ojo-Yoshida Report.

Read More »ST’s Key to Unlock China: ‘Manufacturing’What’s at stake:

Fresh off receipt of U.S. government funding and tax breaks, Intel Corp. is spearheading the effort to revive American chip manufacturing. Will Intel Foundry’s internal sourcing strategy enable it to achieve a projected breakeven in 2027?

On the day it disclosed steep operating losses for its nascent foundry operations, Intel Corp. dropped the other shoe by unveiling a widely expected strategy that separates its fabless products unit from its fledgling foundry business.

The goal, Intel said, is establishing a “foundry-like relationship” among Intel Foundry, the chipmaker’s existing manufacturing operations, and its “product” business unit. The last is essentially the fabless portion of Intel Corp. that designs chips for data centers, networking and, the company hopes, future AI systems.

Read More »Intel Foundry Charts a Course to BreakevenJeff Bier discusses how advances in their basic building blocks are fundamentally changing the nature of embedded systems.

Compiled byThe Ojo-Yoshida Report

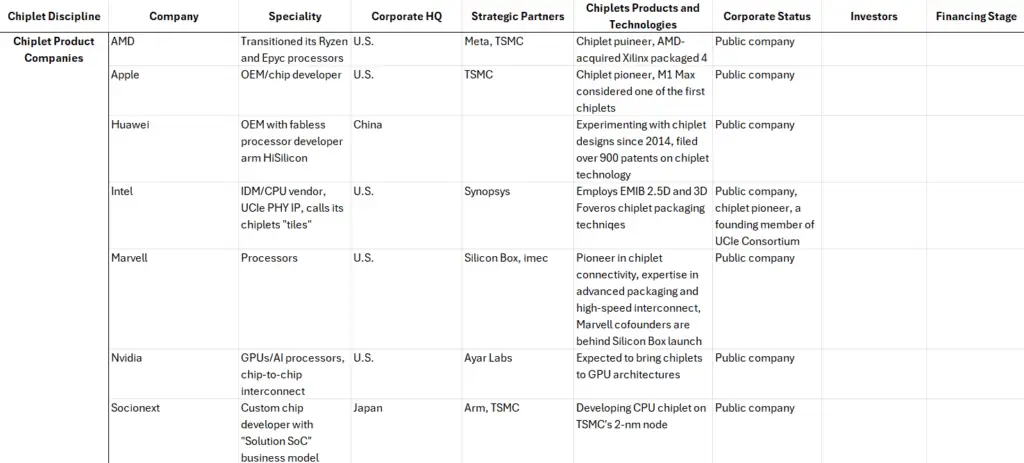

The Ojo-Yoshida Report has compiled a list of key chiplet players in a table below.

We highlight the movers and shakers in the rapidly emerging, and evolving, chiplets ecosystem. The table shows how the semiconductor industry at large is realigning to create a viable ecosystem for chiplets, especially how innovations in advanced packaging and system-in-package (SiP) segments are converging and colliding with chiplet manufacturing disciplines.

Recommended:

Growing Chiplet Ecosystem in a Snapshot

We divided the chiplet marketplace in several categories ranging from chiplet product companies, design startups to chiplet EDA tools/ IP vendors, manufacturing and packaging.

By The Ojo-Yoshida Editorial Team

Chiplets are on nearly every semiconductor firm’s radar; look at the membership of UCIe Consortium, the standards body working on die-to-die I/O physical layer (PHY), die-to-die protocols, and software stacks. UCIe Consortium has more than 130 members and counting.

The Ojo-Yoshida Report has compiled a list of key chiplet players in a table. (You can read our table here). Our goal is to highlight the movers and shakers in the rapidly emerging, and evolving, chiplets ecosystem. The table will also show how the semiconductor industry at large is realigning to create a viable ecosystem for chiplets, especially how innovations in advanced packaging and system-in-package (SiP) segments are converging and colliding with chiplet manufacturing disciplines.

Recommended:

Players: Who’s Who in Chiplets

Moreover, while it displays how prominent players in the semiconductor industry are catching up on the chiplet phenomenon, a new crop of startups is redefining this space with nimble product moves. It also shows how money is flowing in from the investment community joining the artificial intelligence (AI) bandwagon.

Read More »Growing Chiplet Ecosystem In a SnapshotBy Ron Wilson

What’s at stake:

With all the talk of chiplets, it is important to have a perspective on what the real issues are, and where the industry stands with them. Looking into it, we find three categories of answers.

Chiplets, systems in package, multi-die modules — there is a whole new vocabulary growing up around the old idea of putting more than one die into an IC package. By now the words, the technologies they represent, and the supply chains necessary to achieve them are resolving into three main categories, all under the general heading of multi-die modules (MDM).

The first category — well represented by recent massive GPU and datacenter CPU designs — best fits the acronym SiP. The second category — just emerging today — we might call decomposed SoCs. And the third category — arguably still several years away — we can properly call chiplet-based systems. To define each of these, we should discuss the issues that separate them and the issues they have in common.

Read More »The Chiplet Revolution: Where We Stand Today